Executive Summary

This white paper offers a policy proposal for how border carbon adjustments can increase global climate finance, with a focus on the EU Carbon Border Adjustment Mechanism (CBAM). This proposal is designed to offer a “carrot” to developing countries in the form of new funding for decarbonization, to complement the “stick” of carbon pricing introduced by CBAM. By offering a practical way forward for the CBAM to increase finance for clean energy and other carbon mitigation projects in developing countries, we hope to catalyze large volumes of new investment in the Global South, and also to re-energize support for the CBAM as a vital measure in the energy transition.

At its core, CBAM is designed to preserve the level playing field of European firms subject to the EU ETS by imposing an equivalent carbon price on foreign imports. At the same time, CBAM also has core environmental goals, aiming to encourage more countries around the world to adopt carbon pricing measures, and therefore to incentivize decarbonization.

While the positive impacts of CBAM have already begun, with several countries announcing domestic carbon pricing schemes in response to the policy, the EU has also faced significant backlash from its trading partners. Specifically, CBAM has been criticized for disproportionately affecting low- and middle-income countries, which often depend on carbon-intensive exports and may lack the financial resources to decarbonize in response to CBAM. In addition, the lack of domestic carbon pricing systems in most developing nations has left them unable to safeguard CBAM revenues through their own effective carbon price (ECPs), which firms can deduct from their CBAM dues. Critics therefore argue that CBAM risks exacerbating global inequalities, conflicting with principles such as Common but Differentiated Responsibilities.

To address these criticisms, this paper proposes expanding CBAM’s definition of an effective carbon price to account for investment in decarbonization. We suggest this could be enacted by recognizing the retirement of certified “carbon tax assets” representing emissions reductions from carbon mitigation projects such as clean energy. These “carbon tax assets” could be used by firms to match “carbon tax liabilities” arising from CBAM. Exporters to the EU could therefore reduce their CBAM bills by purchasing carbon tax assets, generating investment for decarbonization projects in the Global South.

It is crucial to note that our proposal preserves CBAM’s core objective of maintaining a competitive level playing field by denominating carbon asset deductions in monetary terms, rather than directly offsetting tons of carbon emissions. By linking CBAM deductions to the price paid for carbon assets, exporters face equivalent economic pressures to reduce emissions, avoiding risks of carbon leakage and perverse incentives towards low-quality assets. In other words, unlike previous links between carbon assets and carbon tax liabilities, for example the use of Clean Development Mechanism (CDM) credits in the EU ETS, our proposal does not simply allow a ton to offset a ton, but rather recognizes that the price paid for an offset can be considered a tax, and thus deducted as an ECP.

Mechanically, our proposal operates through two channels to support developing countries burdened by CBAM. First, the “external channel”, where exporters in developed nations purchase carbon assets from developing countries to pay their CBAM liabilities. This might be, for instance, a Japanese steel company exporting to the EU investing in a clean energy project in Mozambique. In this way, the external channel creates a new flow of external carbon finance from Global North to Global South by generating demand for carbon assets.

Second, we propose an “internal channel,” where developing nations can use our flexible definition of an ECP to retain carbon revenues and encourage green investment at home. This would allow domestic firms to offset CBAM obligations through investments in local decarbonization initiatives, for example a steel producer in Azerbaijan funding clean manufacturing and deducting its investment from its CBAM dues.

This proposal comes at a critical time both for border carbon adjustments and for climate finance. At the international level, the recent agreement on Article 6.4 methodologies at COP29 could provide a starting point to define robust eligibility standards for carbon assets. At the same time, the inclusion of border carbon adjustments as part of the COP29 agenda for the first time, within a Presidency’s Consultation to report by COP30, offers a multilateral forum to discuss how this proposal might be enacted.

For the EU, while the Article 6 methodologies establish a foundational framework for international carbon markets, there is the opportunity to “gold-plate” international standards with additional criteria on which carbon assets would count as an ECP. This gold-plating could include metrics such as additionality, permanence, transparency, social impact, and governance. This could enhance carbon market integrity and reinforce the EU’s leadership in global climate governance.

To operationalize our proposal, this white paper contains an appraisal of the next steps that will be necessary from both the EU and its trading partners. For the EU, these include issuing delegated or implementing acts under the CBAM regulation to explicitly recognize carbon mitigation assets as ECPs. As we discuss, it is also possible to directly amend the CBAM regulation via changes to Articles 2 and 9. Simultaneously, EU trading partners will need to enact national legislation governing the use of carbon assets, ensuring alignment with EU criteria. This could involve establishing registries for carbon asset certification and leveraging international standards like those defined at COP29.

Border carbon adjustments, starting with the EU CBAM, represent a huge opportunity for the energy transition, creating incentives for decarbonization and revenue for governments. But for these policies to reach their potential, equity concerns amongst developing country exporters must be addressed. Our hope is to link two great challenges for the energy transition – the need for carbon pricing and the need for climate finance – letting one create a solution for the other. Allowing carbon assets to match carbon liabilities could turn CBAM into both a carrot and a stick. This aims to present a practical and just way forward.

Introduction

The EU’s Carbon Border Adjustment Mechanism (CBAM) is the world’s first instance of a border carbon adjustment, designed to ensure that EU firms subject to the Emissions Trading Scheme (ETS) can maintain a level playing field with foreign exporters. Like all border carbon adjustments, CBAM operates by imposing the same carbon price on imports as is faced by domestically produced goods.

The explicit goal of CBAM, as stated in Article 1 of the CBAM Treaty, is to prevent “carbon leakage” from the ETS by taxing greenhouse gas emissions embedded in imported goods (von der Leyen, 2020).1 This reduces the incentive for relocation of production from the EU to pollutive jurisdictions that do not have carbon pricing. Initially focused on steel, aluminum, cement, fertilizers, electricity, and hydrogen,2 CBAM entered its transitional phase in 2023 and will be fully implemented by January 2026, phasing in thereafter.3

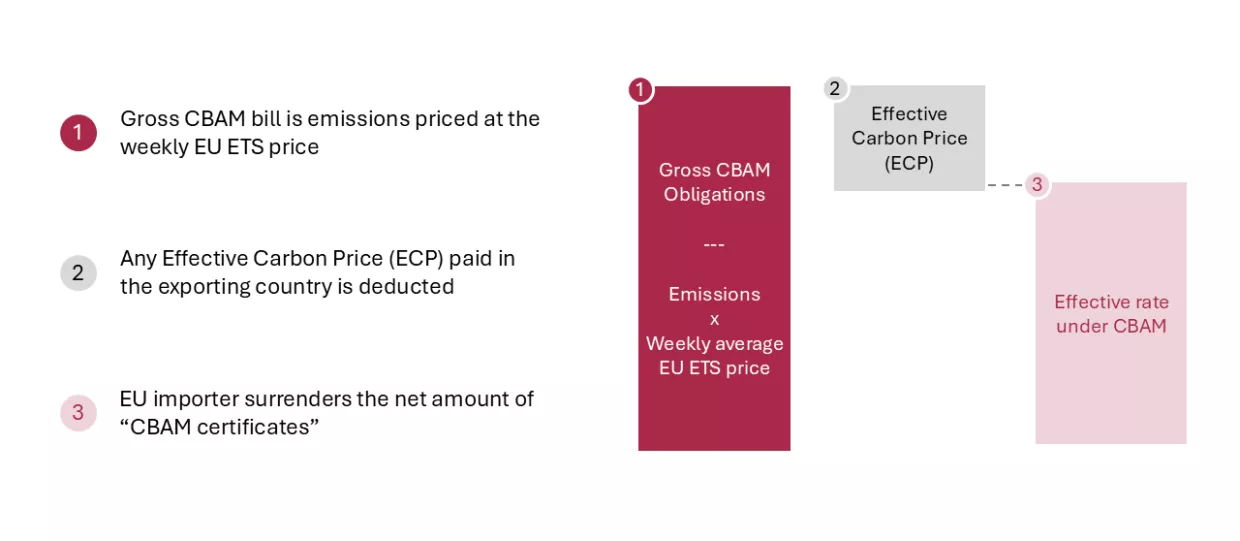

Mechanically, CBAM is paid by surrendering CBAM certificates, which importers purchase from the EU.4 Importers must purchase certificates corresponding to goods’ embedded carbon emissions at a price equivalent to the average cost paid by EU firms under the ETS, calculated weekly.5 Certificates can be bought at any time, remaining valid for two years.6

For imports other than electricity, the emissions calculation used in the CBAM must be calculated based on “actual” emissions, i.e., measurement rather than averages.7 Because such data is not universally available, when “actual” emissions cannot be verified, the EU Commission will provide default values, based upon the average emission intensity of the worst-performing EU ETS installations for that type of goods can be used.8

As well as leveling the playing field for EU firms versus foreign exporters, the CBAM has two major environmental policy aims. First, like traditional carbon pricing schemes, CBAM incentivizes foreign producers to decarbonize by making firms pay a price on the carbon dioxide they emit. Second, at a policy level, CBAM encourages foreign governments to adopt carbon pricing (Clausing et al., 2024; Clausing and Wolfram, 2023). This is because under Article 9 of the CBAM, firms can deduct the “Effective Carbon Price” (ECP) paid in their home jurisdiction from their CBAM dues. This deduction is shown in Figure 1.

Article 9 ECP deductions encourage carbon pricing by presenting governments outside the EU with an easy choice: operate without a carbon price, and therefore forfeit carbon taxes to the EU, or impose an ECP and keep that revenue at home. This aims to create a “virtuous circle,” where more carbon prices encourage more CBAMs, in turn encouraging more carbon prices (Figure 2). The effects of this virtuous circle are already being seen in a growing list of EU trading partners, including India, Indonesia, Morocco, Turkey, Ukraine, Uruguay, and Western Balkan countries all currently developing domestic carbon pricing schemes to reduce their CBAM exposure and retain the associated carbon tax revenues (Chang, 2025; East and Dept, 2023).

Although CBAM has been commended for promoting carbon pricing and accelerating decarbonization efforts, it has also been criticized for levying its most significant burdens on countries least equipped to cope with the resulting tariffs (Corvino, 2023; Perdana and Vielle, 2022). This is because developing nations face heightened exposure to CBAM due to their reliance on carbon-intensive industries (Beaufils et al., 2023). One World Bank report has highlighted that low- and lower-middle-income countries are three times more vulnerable to CBAM than wealthier nations (World Bank, 2023).

As Xana Maunze, a Climate Finance Official at Enabel, the Belgian Development Bank, commented to us in an interview for this paper, Mozambique relies on the EU for 75% of its CBAM-related exports. Mozambique could therefore see CBAM impact on 7% of the country’s GDP (The Economist, 2023). More generally, developing nations might struggle to adopt lower-carbon energy systems or enhance production efficiency due to financial and infrastructural limitations, constraining the ability of firms to decarbonize and leaving them facing high CBAM burdens (Eicke et al., 2021).

Structural challenges for developing countries dealing with CBAM are further compounded by the fact that many developing nations lack the technical and financial resources needed to establish carbon pricing mechanisms, preventing them from retaining revenue through an ECP (Carattini, 2022). Of the 70 low- and lower-middle-income countries worldwide, only Ukraine has a functional domestic carbon pricing system (Pleeck and Mitchell, 2023).

More broadly, encouraging carbon pricing in the least developed countries risks conflicting with the principle of Common but Differentiated Responsibilities and Respective Capabilities (Bednarek, 2023; Corvino, 2023.; den Heijer and van der Wilt, 2022). As part of a just transition, many developing nations have argued that carbon pricing should factor in historical emissions to distribute costs more equitably (Bednarek, 2023). These objections are not only significant for their impact on developing nations but also because they risk undermining broader acceptance of CBAM policies, hindering the EU's role as a leader in global climate initiatives (Assous et al., 2021).

As well as developing countries, CBAM has also faced pushback from developed nations, which argue that the policy could unfairly penalize their exporters by failing to account for regulatory costs such as environmental standards or indirect carbon taxes like fuel duties as ECPs (Boute, 20a24; Durán, 2023; Espa, 2022).

To address the challenges for EU trading partners discussed above, European policymakers proposed several measures during the CBAM’s legislative discussions to lessen the policy’s impact on developing countries (Hua, 2023). These included directing a portion of EU CBAM revenues toward a dedicated fund for climate finance, as well as exemptions or phased implementation for certain trading partners (Ruiz, 2023). These proposals were included in the European Parliament's Amendments 40 and 41 to the CBAM regulation, adopted in June 2022. However, despite considerable political backing, the proposals were not incorporated into the final law due to concerns about weakening the competitive balance for EU industries, the risk of carbon leakage, and resistance to increasing international development funding.

To tackle the challenges CBAM presents for EU trading partners while preserving fair competition, this white paper presents a new proposal for how the CBAM can be adapted to support a just transition. Specifically, we recommend expanding the definition of an ECP to include investments in decarbonization. Under this proposal, carbon mitigation projects would generate “carbon assets” representing emissions reductions, which firms could then use to pay their CBAM bills. As is explored in detail later on, this would generate a new form of climate finance in the Global South, with developed country exporters funding projects as a means to pay off their carbon duties. At the same time, this proposal could also let developing countries keep carbon revenues at home and encourage firms to invest in decarbonization, without the need to implement a full traditional carbon price.

It is important to note that “carbon assets” are structurally similar to a wide range of existing financial instruments such as carbon credits and offsets. However, due to the challenges inherent in offset markets—including the risk of low-quality projects—it will be critical for the EU to enforce strict criteria when determining which carbon assets qualify as an ECP payment. Such guardrails are discussed later in this paper.

While the concept of linking carbon assets to compliance carbon pricing systems is not new, the unique opportunity of the EU’s CBAM provides an unprecedented occasion for new policymaking. As we will demonstrate, allowing carbon assets to count as ECPs could uphold the competitive balance of EU firms, reduce carbon leakage risk, unlock climate finance for developing nations, and position the EU as a leader in carbon market standards.

Carbon Tax Assets and Carbon Tax Liabilities

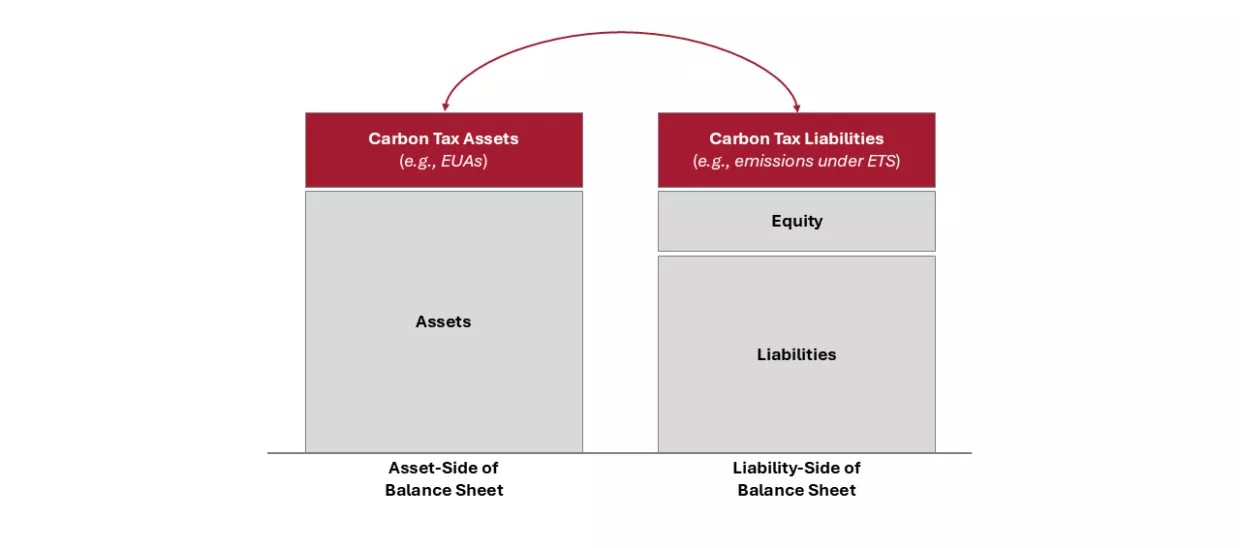

From an accounting perspective, we propose that carbon pricing should be understood to establish a “carbon tax liability” on a firm’s balance sheet, representing its obligations based on greenhouse gas emissions (Figure 3). These liabilities can be settled through direct payments (such as a tax) or by using "carbon tax assets," including allowances like EU allowances (EUAs) under an ETS. For CBAM compliance, firms address carbon tax liabilities by purchasing CBAM certificates or proving the payment of an ECP.

Today, carbon tax liabilities cover approximately 24% of global emissions—a sharp increase from just 7% a decade ago (World Bank, 2024). This growth has been fueled by carbon taxes and emissions trading systems in emerging economies like Brazil, India, and Türkiye. As more nations introduce carbon pricing, the push for CBAM adoption will grow, driven by the need to safeguard domestic industries. In turn, this will encourage more governments to establish their own carbon pricing frameworks to retain revenues, creating a self-reinforcing cycle (Figure 2).

In the case of CBAMs, firms’ carbon tax liabilities are based on emissions embedded in exports and can be reduced by demonstrating payment of an ECP in the exporting country. When the CBAM was drafted, it was imagined that ECPs would take the form of “traditional” carbon pricing in the form of direct carbon taxes or compliance credits under emissions trading systems.9

At a practical level, it is important to note that the CBAM currently does not consider indirect carbon prices as an ECPs. Such indirect carbon pricing instruments include fuel taxes, which increase the price of carbon-intensive goods but do not directly impose an effective government-legislated price. In addition, when calculating the ECP, firms must deduct “any rebate or other form of compensation available in [the third] country that would have resulted in a reduction of that carbon price.10 The aim of this condition is to block foreign exporters paying carbon prices and simply being reimbursed by their home governments.

Currently, several non-EU carbon prices are widely expected to be recognized as ECPs, including the California Cap-and-Trade Program, the U.S. Regional Greenhouse Gas Initiative, the China ETS, and the South Korea ETS. These are shown in Table 1.

| Jurisdiction | Carbon Pricing Mechanism | Level (USD) |

|---|---|---|

| EU | Emissions Trading Scheme | $73 |

| UK | Emissions Trading Scheme | $59 |

| California | Emissions Trading Scheme | $44 |

| USA Northeast (RGGI) | Emissions Trading Scheme | $21 |

| China | Emissions Trading Scheme | $12 |

| Singapore | Carbon Price | $18 |

Voluntary Carbon Tax Assets and Carbon Tax Liabilities

In addition to traditional tax assets, in recent years, voluntary carbon assets—commonly referred to as carbon offsets—have emerged as a policy tool to finance carbon mitigation. Unlike compliance credits, which are issued by governments, voluntary offsets are derived from projects designed to reduce or remove CO2 emissions, with each credit representing a verified claim of such reductions or removals. Currently, voluntary carbon markets remain small, valued at around $2 billion, compared to $1 trillion in global carbon tax schemes (World Bank, 2024).

Historically, there have been several initiatives to allow voluntary carbon assets to function as carbon tax assets, i.e., to recognize the retirement of voluntary carbon assets as payment of a carbon tax liability. A notable example is the integration of Clean Development Mechanism (CDM) credits into the EU ETS. The CDM, established under the Kyoto Protocols, allowed industrialized nations to meet their emissions reduction targets by purchasing credits from projects in other countries (Klepper and Peterson, 2006). Initially, these credits were accepted under the ETS, enabling firms to use them as substitutes for EUAs. However, concerns over the additionality of projects, oversupply issues, and the resulting price collapse led the EU to restrict and eventually phase out CDM credits (Koch et al., 2014; Nazifi, 2010).

At a national level, there have also been historical precedents of carbon pricing systems recognizing voluntary carbon assets as a means to pay carbon tax liabilities, usually to drive domestic investment. In New Zealand, offset revenues have facilitated the reforestation of nearly half of all post-1989 forest land (Shrestha et al., 2022). Similarly, California’s Cap-and-Trade Program allows firms to cover up to 6% of their carbon tax liabilities using offsets, with at least half of these projects mandated to deliver benefits within California. At the same time, however, it is important to remember that such schemes remain vulnerable to risks of environmental integrity, as evidenced by instances of problematic credits (Haya et al., 2020).

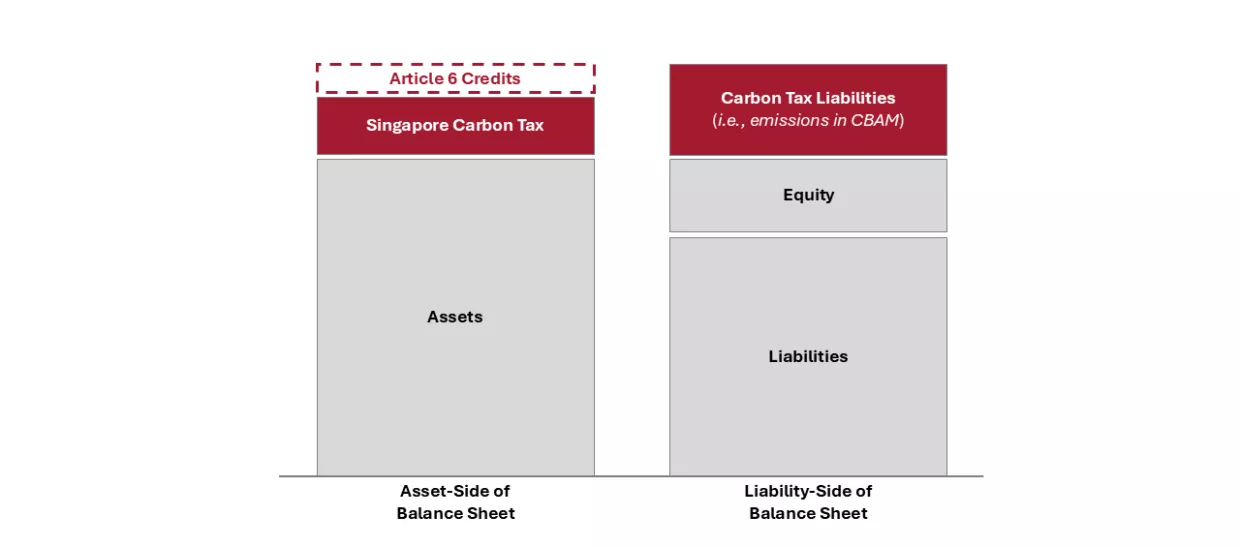

Most recently, several jurisdictions have started integrating carbon assets authorized under international carbon markets created by Article 6 of the Paris Agreement into their domestic carbon pricing systems. Credits under Article 6 are similar in structure to voluntary offsets and are generated from projects reducing or removing emissions. While the history of Article 6 credits is beyond the remit of this paper, with the most recent agreement on modalities for Article 6.4 methodologies adopted at COP29 in Baku in 2024, more and more systems are expected to explore such a link. Singapore’s carbon tax, for example, permits firms to use internationally transferred mitigation outcomes (ITMOs) to offset up to 5% of their taxable emissions (Rafiqi and Mentari, 2024). Switzerland employs a similar approach, requiring motor oil importers to retire ITMOs to fulfill domestic carbon tax obligations, effectively treating them as a form of carbon tax payment (Greiner et al., 2020).

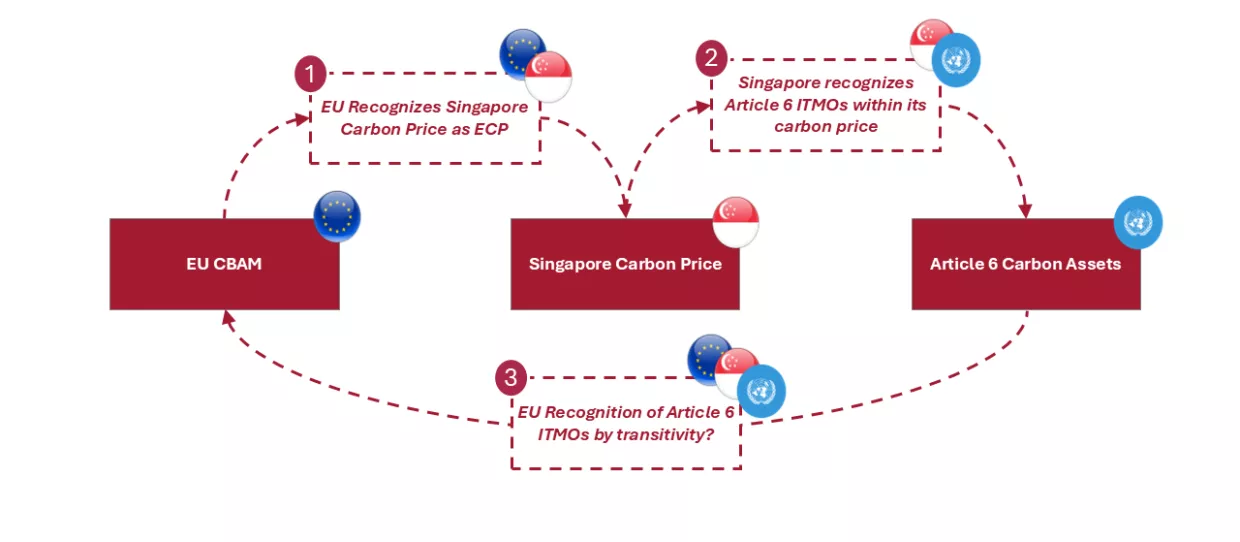

The Problem of Transitivity

The recognition of voluntary carbon assets, such as Article 6 credits, as carbon tax assets within domestic carbon pricing systems around the world poses significant questions for the EU’s CBAM. The first issue, which we name the “problem of transitivity,” arises when voluntary carbon assets are used to pay a carbon price outside the EU, meaning the CBAM implicitly recognizes such credits “by transitivity.” As discussed above, Singapore allows firms to pay part of its carbon pricing system via Article 6 credits. If, as is likely, the EU recognizes the Singaporean carbon tax as an ECP, by default, the EU will also automatically recognize the use of Article 6 credits, even without explicitly legislating for it. This is shown in Figure 4.

From an accounting standpoint, the problem of transitivity is shown in Figure 5, and affects not only jurisdictions like Singapore that incorporate Article 6 credits but also other compliance systems using voluntary assets, such as carbon dioxide removal credits in California’s Cap-and-Trade program.

The Problem of Denomination

The second immediate question for the CBAM created by inclusion of voluntary carbon tax assets in carbon pricing schemes is what we term the “problem of denomination.” The problem of denomination stems from the mismatch between carbon assets, measured in tons of CO2, and CBAM obligations, expressed in EUR.

To demonstrate the problem of denomination, imagine a firm exporting goods with 100 tons of embedded CO2 emissions to the EU. Suppose the firm acquires 100 tons of eligible voluntary carbon assets. The EU might allow these assets effectively neutralize the firm’s carbon emissions for CBAM calculations, i.e., there is a one-to-one conversion of the assets, denominated in tons, to the price of CO2, denominated in EUR. That is the system previously employed under the EU ETS with CDM credits.

Given the many problems with allowing voluntary carbon tax assets to offset carbon tax liabilities on a ton-for-ton basis, we instead suggest a new approach to recognizing carbon tax assets based on valuing the carbon tax assets in monetary terms. Under this proposal, firms will denominate carbon tax assets in EUR, allowing them to deduct a certain amount, for example the price paid for the assets, from their CBAM bills. These valuation and accounting questions are explored further in the next section.

Policy Discussion

This paper proposes that the EU, and countries implementing border carbon adjustments more generally, should broaden the definition of ECPs to include the retirement of specific voluntary carbon assets. Under this proposal, exporters to the CBAM could purchase eligible carbon assets derived from mitigation or removal projects, submit them to their respective governments, and receive certification demonstrating payment of an ECP. These certified carbon assets would then be used to reduce the exports’ CBAM liabilities, provided they meet the EU’s eligibility criteria.

The main motivator for this proposal is the urgent need to increase climate finance globally, especially in the context of the CBAM’s large effect on developing countries. Recognizing certain carbon assets as ECPs would meet this goal by stimulating investment in carbon mitigation projects by establishing a new compliance-driven investor base, i.e., firms seeking to reduce their CBAM bills.

Mechanically, our proposal leverages two channels to support developing countries facing the CBAM. These two channels—the external channel and the internal channel—both redirect financial resources that would otherwise flow to the EU, back to the countries impacted by CBAM. Notably, neither channel involves direct investment from the EU or European firms, but rather the reallocation of non-EU private-sector funds.

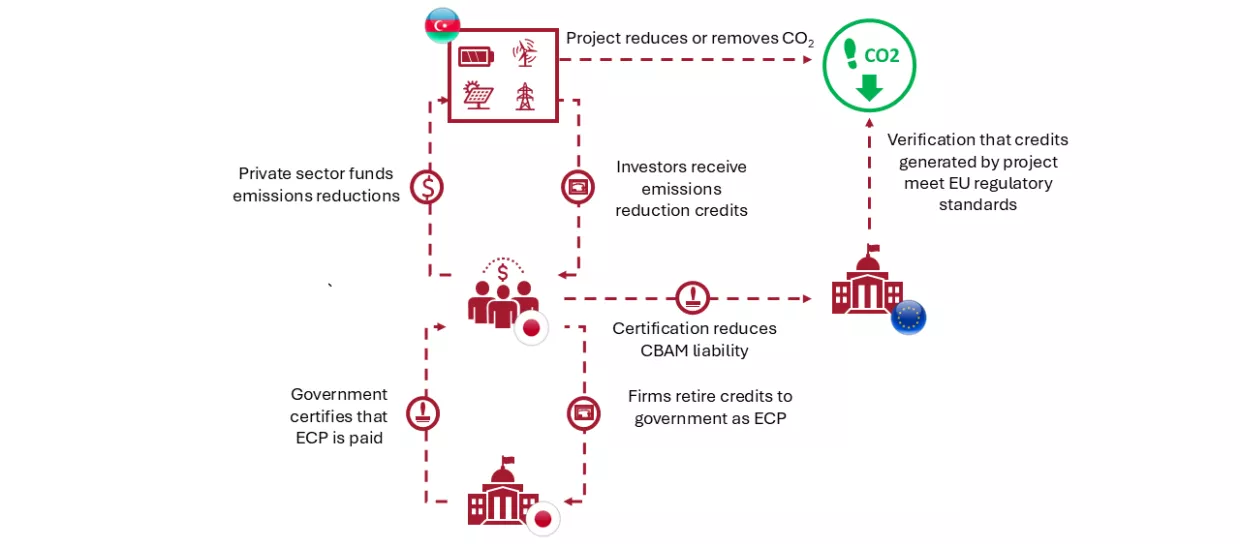

Through the external channel, exporters from developed countries reduce their CBAM liabilities by purchasing carbon assets from developing nations, thereby funding decarbonization initiatives in the Global South. For example, a Japanese steel producer might lower its CBAM obligations by investing in renewable energy projects in Azerbaijan. This is shown in Figure 6.

The external channel is particularly relevant for developed countries lacking a carbon price or with carbon pricing systems that fall below the EU’s level, allowing them to meet their CBAM obligations using assets generated in developing countries.

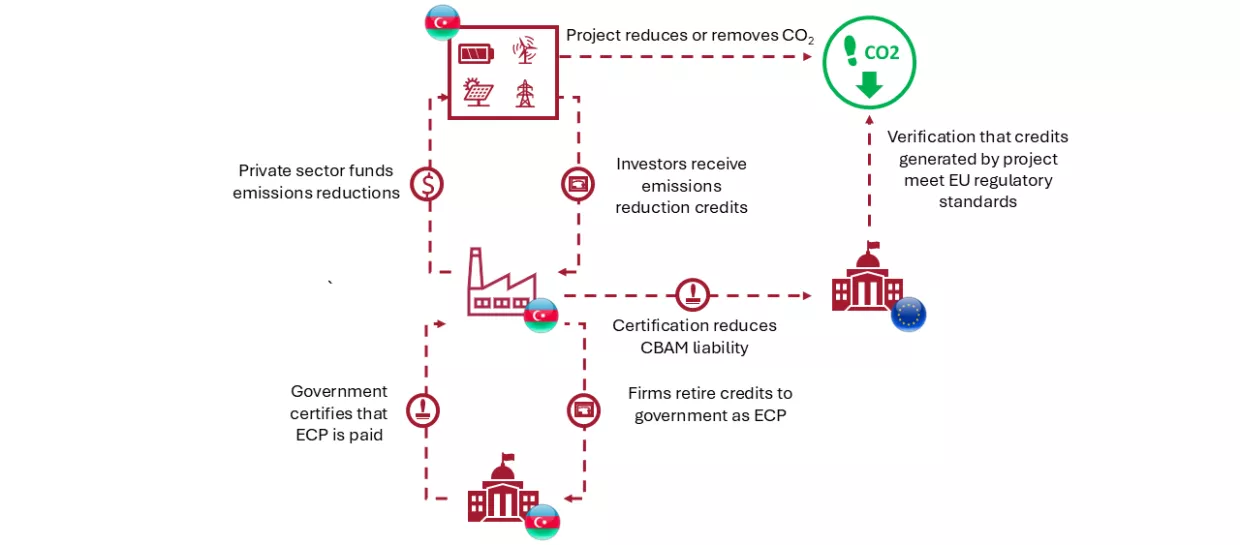

Through the internal channel, governments in developing countries can use the flexible definition of an ECP proposed in this paper to redirect CBAM-related payments toward domestic decarbonization efforts. For instance, a steel manufacturer in Azerbaijan might invest in less carbon-intensive production methods, converting what would have been a payment to the EU into an internal investment. Unlike the external channel, this mechanism does not attract foreign financing but ensures that the funds stay within the developing country, fostering local climate action. This is shown in Figure 7.

From a regulatory perspective, under our proposal, both the EU and developing country would retain oversight of eligibility rules for generating carbon tax assets. For the EU, it will be crucial to ensure investments adhere to strict criteria like additionality and environmental integrity. For recipient governments, it will be important to approve specific projects or project categories as eligible to generate carbon assets, potentially using tools like “white lists.” This dual governance approach will ensure that investments are efficiently directed toward decarbonization projects in sectors most affected by CBAM, particularly in vulnerable trading partner nations.

Beyond CBAM’s core objectives, we see an ancillary benefit to this proposal as significantly advancing the EU’s climate ambitions by bolstering the integrity of carbon markets, particularly under Article 6 of the Paris Agreement. With CBAM revenues projected to reach $80 billion annually by 2040—compared to the current $2 billion voluntary carbon market (Evans et al., 2024)—recognizing eligible carbon assets as ECPs would hugely increase the scale of carbon finance globally while also allowing the EU to shape global standards for asset eligibility. By dominating market demand, the EU could take advantage of the “Brussels Effect,” where European standards for eligible assets would become the market norm, given the sheer proportional size of the EU in terms of demand for credits (Bradford, 2020). This would align with the EU’s commitment to promoting robust carbon markets and reinforcing its leadership role in international forums like COP28 and COP29.

The effect of this proposal on carbon markets is particularly salient post-COP29, with the principles agreed for Article 6.4 carbon trading. By gold-plating the eventual UNFCCC methodologies, the EU could in effect add more environmental, social, and governance safeguards onto the global Article 6 market.

In the longer term, as well as using the CBAM to increase international climate finance via ECPs, the EU also could eventually allow carbon assets generated within the EU to qualify as ECPs for foreign firms exporting to Europe. This would direct investment from non-EU firms toward EU-based projects, such as carbon capture and green hydrogen, were such emissions reductions qualified as ECPs. Such an approach would support the EU’s climate objectives by drawing financing into advanced technologies and potentially offsetting revenue losses from CBAM through domestic innovation. However, this strategy would require a careful balance, as it could reduce the availability of climate finance for developing nations. As an important clarification, such a policy could still be implemented even though carbon assets would remain ineligible for inclusion under the EU ETS for EU firms.

Maintaining the EU Level Playing Field

Within the EU, the CBAM’s core mandate is to create a level playing field for European firms while minimizing carbon leakage. Any new measures to support trading partners must therefore ensure that non-EU exporters face financial penalties comparable to those borne by EU companies under the ETS. Moreover, it is critical to maintain the economic incentive for foreign firms to reduce their emissions.

To safeguard EU policy goals while also generating the benefits for EU trading partners outlined above, our proposal is based on the idea that carbon assets recognized as ECPs should offset CBAM liabilities only to the extent of their monetary value, not through a direct one-to-one CO2 tonnage offset. This ensures the cost of acquiring a carbon tax asset matches the liability EU firms face, reinforcing the principle of an "effective" carbon price. The valuation of carbon tax assets in EUR—determining the deduction per ton of CO2—is therefore a pivotal issue.

The importance of this point cannot be overstated. Unlike under the CDM, where credits included in the EU ETS reduced firms’ carbon tax exposure by the CO2 ton value of the carbon asset retired, we propose taking a fundamentally different approach. Instead of carbon assets “offsetting” carbon liabilities, they are being deducted as a form of carbon pricing. This means that, like under a traditional carbon tax, exporters to the EU would still face a commensurate effective price on carbon via their purchase of offsets, reducing the anti-competitive distortions and incentives for carbon leakage. As Teppo Säkkinen, Senior Advisor for Climate, Energy and Industries at Finland’s Chamber of Commerce, commented during an interview for this paper, “Article 9 talks about the price, not CO2 tons, and the proposal [to accept offsets as an ECP] still requires the importer to pay.”

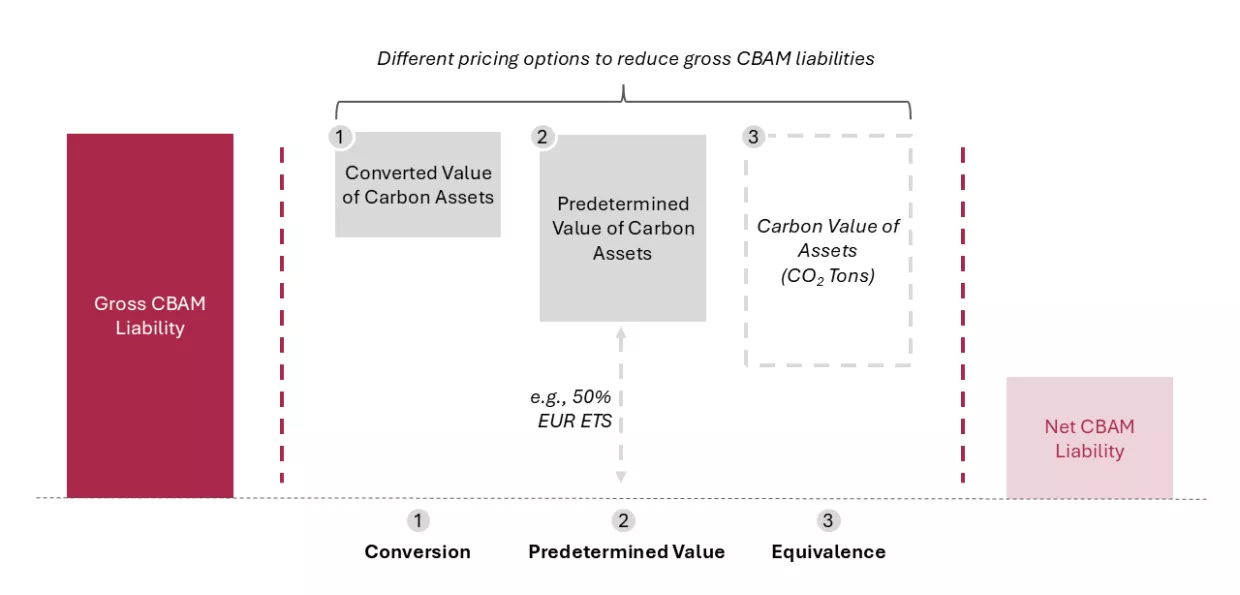

We see three broad approaches to determine the valuation under which carbon assets are deduced as an ECP.

Approach 1 – Conversion

The “conversion” approach aims to translate the CO2 tons of carbon assets into EUR based on an appropriate conversion rate. Ideally, this rate would be the actual price paid by the exporter. For example, if carbon assets are purchased at $50 per ton, firms would be able to deduct $50 per ton from their CBAM liabilities. By directly linking the ECP to the carbon asset’s cost, this method ensures firms face the same economic decision whether to pay the CBAM fee or purchase carbon assets.

At a practical level, however, carbon asset prices are often not publicly disclosed, as firms typically do not report transaction details. Additionally, financial contracts may involve complex mechanisms like embedded options (Sandler and Schrag, 2022). As an alternative, therefore, other conversion methods are also possible, for example a mark-to-market approach to value assets at their current market price when retired. Such an approach also comes with complications, however, as the lack of a liquid index for carbon assets may complicate such a strategy. In addition, using benchmarks, even if available, could increase price volatility, encouraging firms to time purchases based on price fluctuations.

Approach 2 – Pre-determined Value

The “pre-determined value” approach would assign either a fixed monetary value (e.g., EUR X per ton) or a proportional value (e.g., X% of the EU ETS price) to retired carbon tax assets. Some research has indicated, for example, that setting this value at 50% of the prevailing local carbon price could effectively incentivize decarbonization efforts (Balistreri et al., 2019)). Policymakers could use this approach to regulate demand for carbon assets strategically. For example, if the fixed value is set lower than the ETS market price, firms would be motivated to purchase carbon assets instead of paying CBAM fees. Additionally, capping the proportion of liabilities that can be offset with carbon assets would help maintain the incentive for developing countries to adopt traditional carbon pricing systems.

Approach 3 – Equivalence

The “equivalence” approach would consider eligible carbon tax assets equivalent to EU Allowances (EUAs) within the ETS, allowing firms to reduce their CBAM liabilities directly based on the retired CO2 tonnage. Already employed by jurisdictions like Singapore for ITMOs, this method simplifies the process by making carbon assets fully interchangeable with CBAM certificates.

Our own recommendation would be to avoid the equivalence approach, as it could lead to carbon leakage if the carbon assets are significantly cheaper than EUAs, as firms may opt to purchase inexpensive assets instead of investing in meaningful emissions reductions.

The three approaches summarized above are illustrated in Figure 8. A flexible framework could also be considered, enabling the EU to tailor its methodology based on specific circumstances. Further research will be essential to determine which pricing strategy is most effective and equitable.

Criteria for Eligible Carbon Assets

The EU’s process for determining which carbon assets qualify as ECPs should consider a range of critical safeguards. While this paper does not propose specific standards, several international frameworks are available to ensure voluntary carbon assets are real, verified, permanent, and additional. One viable approach would be to align EU criteria with the compliance market under Article 6 of the Paris Agreement. Such alignment would bolster the UN’s carbon market and address the “problem of transitivity” in jurisdictions like Singapore, where Article 6 credits are already integrated into domestic carbon pricing systems. Moreover, by establishing stricter environmental integrity requirements for Article 6 credits, the CBAM could solidify the EU’s leadership in defining global carbon market rules, as it has advocated in international forums like COP28. With the EU’s dominant market influence, this could set global standards through the “Brussels Effect” (Bradford, 2020).

Alternatively, the EU could leverage CBAM to drive investment in domestic climate initiatives by recognizing locally generated carbon assets. Such a strategy would attract private capital to advanced technologies, including carbon removal, long-duration energy storage, and green hydrogen. Existing mechanisms, such as the Carbon Removals and Carbon Farming Framework (CRCF), could play a key role in certifying domestic projects focused on carbon removals, farming practices, and storage solutions.

Practical Considerations and Next Steps in Recognizing Carbon Tax Assets as ECPs

Under current CBAM rules for ECP deductions, governed by Article 9, the definition of a carbon price is found in Article 2: “tax, levy, fee, or an emission allowance under a GHG emissions trading system.”

"A CBAM declarant may claim in the CBAM declaration a reduction in the number of CBAM certificates to be surrendered in order to take into account the carbon price paid in the country of origin for the declared embedded emissions. [...] In such a case, any rebate or other form of compensation available in that country that would have resulted in a reduction of that carbon price shall be taken into account." — Article 9

"'Carbon price' means the monetary amount paid in a third country, under a carbon emissions reduction scheme, in the form of a tax, levy or fee or in the form of emission allowances under a greenhouse gas emissions trading system." — Article 2

At a practical level, current accepted definitions of ECPs—outside the EU CBAM legislation—do leave some room for interpretation regarding voluntary carbon assets (Boute, 2024). The World Bank, for instance, broadly categorizes carbon pricing instruments as “mechanisms generating ‘tradable certificates representing emission reductions,’” a definition that could encompass offsets (World Bank, 2024). Some experts have also suggested that voluntary carbon pricing could serve as a strategic response to the EU CBAM in the United States (Benson et al., 2022).

Next steps for the EU: A practical way forward for the EU to implement this proposal would be for the EU Commission to issue either a delegated act to Article 2, or an implementing act to Article 9, explicitly allowing certain voluntary carbon assets to be recognized as ECPs.11 Alternatively, EU member states could amend Article 9 or Article 2 via the Parliament to formally include carbon assets alongside taxes, levies, and allowances.

Whichever route the EU takes, an implementing act, delegated act or Parliamentary amendment could specify that assets are considered equivalent to fees or allowances within an emissions trading system, provided they adhere to strict standards for environmental integrity and additionality. With two years remaining in the CBAM transitional phase, this regulatory adjustment could potentially be executed within the existing window. We have discussed both pathways with the EU Commission and various EU member states and intend to pursue further dialogue on the best way forward.

Next steps for non-EU countries: For EU trading partners, leveraging the flexibility of ECPs proposed in this proposal would require national legislation to govern the use of carbon assets.

This is because, according to the EU Commission’s 2023 Implementing Regulation, firms must demonstrate the existence of a legal act governing the carbon price and provide supporting documentation. Practically, such frameworks could rely on international standards, such as the Article 6.4 guidelines adopted by the UNFCCC at COP29, Singapore’s rules for Article 6 ITMOs, or established private-sector protocols. This approach would present fewer administrative challenges than adopting a full-fledged carbon pricing system. Further research should examine how such legislation could be designed to minimize bureaucracy while maintaining rigorous environmental standards.

Conclusion

The CBAM offers the EU a pivotal opportunity to lead not only in carbon pricing but also in mobilizing climate finance. This paper has proposed that the EU expand its CBAM framework to recognize specific carbon assets as ECPs, allowing exporters to meet CBAM obligations by matching “carbon tax assets” with “carbon tax liabilities.” This approach is not intended to replace traditional carbon pricing mechanisms but rather to complement them, particularly in cases where domestic carbon prices fall below the CBAM threshold.

The primary aim of this proposal is to reinforce CBAM’s goal of preventing carbon leakage while maintaining fair competition for EU producers. By offering a practical solution the challenges created by the CBAM, this approach addresses institutional barriers in developing countries, facilitating the broader adoption of carbon pricing and enabling these nations to retain revenue domestically. Simultaneously, recognizing carbon asset-based ECPs would establish a compliance-driven market for eligible carbon tax assets, providing EU trading partners with a “carrot” in the form of climate finance, which complements the “stick” of carbon border adjustments.

As Adriaan Tas, Climate Finance Advisor at Ministry of Economy and Finance in Mozambique, commented in an interview for this paper, the CBAM poses challenges for low-income countries. It is difficult to introduce a tax because it adds to production costs but at the same time also difficult to mobilize funding to finance low-carbon solutions because of high costs of capital. However, as Tas comments, “imagine if a low-income country could sell carbon credits from an energy project to a CBAM importer, then you create a win-win: you mobilize funding to implement the RE project; and you reduce the CBAM exposure. That’s indeed a nice carrot.”

At a practical level, to advance this proposal, we have shown how the EU Commission could issue guidance or adopt implementing acts to integrate carbon assets as ECPs under Article 9. Alternatively, the EU could pursue a more comprehensive legislative route, revising the CBAM Regulation through the European Parliament and Council. Key challenges remain, including defining eligible carbon assets and establishing valuation mechanisms to preserve market integrity and prevent misuse.

As climate challenges grow increasingly urgent, the need for policies that balance enforcement with incentives becomes more critical. This proposal provides a clear pathway to achieve these goals, drawing on global experience with carbon pricing systems and carbon asset recognition. CBAM may serve as a climate enforcement tool, but aligning carbon assets with carbon liabilities gives the EU an opportunity to add a meaningful incentive—a climate finance carrot to complement the CBAM stick.

Disclosure

The Harvard Kennedy School’s Belfer Center for Science and International Affairs is grateful to the Abu Dhabi Commercial Bank for an unrestricted gift that in part supported this research.

Acknowledgements

The authors would like to thank Christine Jiang for her help in all aspects of the research and writing of this paper.

The authors would also like to thank the many experts, policymakers and market practitioners who gave their time and comments in the creation of this paper. These include, but are not limited to, Xavier Vanden Bosch from the EU Commission, Teppo Säkkinen from the Finland Chamber of Commerce, Adriaan Tas from the Mozambique Ministry of Economy and Finance, Xana Maunze from Enabel, Samira Musayeva and Farid Chingiz oglu Isayev from the Azerbaijan Ministry of Economy, Andy Baker, Parag Dandgey, Natasha Stotesbury and James Beeson from the UK Foreign, Commonwealth and Development Office, Perumal Arumugam from the UNFCCC, Thomas Birr from E.ON, Ivano Iannelli from Emirates Global Aluminum, André Sapir, Heather Grabbe and Cecilia Trasi from Bruegel, Joe Aldy from the Harvard Kennedy School, Catherine Wolfram from MIT, and Serena Liau from the Singapore Ministry of Trade & Industry.

Bibliography

Assous, A., Burns, T., Tsang, B., Vangenechten, D., Schäpe, B., 2021. A storm in a teacup. Impacts and geopolitical risks of the European carbon border adjustment mechanism. Energy Foundation China. https://www.efchina.org/Attachments/Report/report-po-20210913/E3G-Sandbag-CBAM-Paper-Eng.pdf.

Balistreri, E.J., Kaffine, D.T., Yonezawa, H., 2019. Optimal environmental border adjustments under the General Agreement on Tariffs and Trade. Environmental and Resource Economics 74, 1037–1075.

Beaufils, T., Ward, H., Jakob, M., Wenz, L., 2023. Assessing different European Carbon Border Adjustment Mechanism implementations and their impact on trade partners. Communications Earth & Environment 4, 131. https://doi.org/10.1038/s43247-023-00788-4

Bednarek, J., 2023. Is the EU Realizing An Externally Just Green Transition? An Analysis of the Carbon Border Adjustment Mechanism from the Perspective of the Common but Differentiated Responsibilities Principle. An Analysis of the Carbon Border Adjustment Mechanism from the Perspective of the Common but Differentiated Responsibilities Principle (May 1, 2023).

Benson, E., Majkut, J., Reinsch, W.A., Steinberg, F., 2022. Analyzing the European Union’s Carbon Border Adjustment Mechanism. JSTOR.

Boute, A., 2024. Accounting for Carbon Pricing in Third Countries Under the EU Carbon Border Adjustment Mechanism. World Trade Review 23, 169–189. https://doi.org/10.1017/S1474745624000107

Bradford, A., 2020. The Brussels effect: How the European Union rules the world. Oxford University Press, USA.

Carattini, S., 2022. Political challenges of introducing environmental tax reforms in developing countries. World Bank.

Chang, J., 2025. Implementation of the EU carbon border adjustment mechanism and China’s policy and legal responses. Environmental Impact Assessment Review 110, 107683.

Clausing, K., Elkerbout, M., Nehrkorn, K., Wolfram, C., 2024. How Carbon Border Adjustments Might Drive Global Climate Policy Momentum.

Clausing, K.A., Wolfram, C., 2023. Carbon border adjustments, climate clubs, and subsidy races when climate policies vary. Journal of Economic Perspectives 37, 137–162.

Corvino, F., 2023. The Compound Injustice of the EU Carbon Border Adjustment Mechanism (CBAM). Ethics, Policy & Environment 1–20. https://doi.org/10.1080/21550085.2023.2272237

den Heijer, M., van der Wilt, H., 2022. Global Solidarity and Common but Differentiated Responsibilities, in: Netherlands Yearbook of International Law 2020: Global Solidarity and Common but Differentiated Responsibilities. Springer, pp. 3–12.

Durán, G.M., 2023. Securing compatibility of carbon border adjustments with the multilateral climate and trade regimes. International & Comparative Law Quarterly 72, 73–103.

East, I.M.F.M., Dept, C.A., 2023. Morocco: Request for an Arrangement Under the Resilience and Sustainability Facility-World Bank Assessment Letter for the Resiliency and Sustainability Facility. IMF Staff Country Reports 2023, A002. https://doi.org/10.5089/9798400254963.002.A002

Eicke, L., Weko, S., Apergi, M., Marian, A., 2021. Pulling up the carbon ladder? Decarbonization, dependence, and third-country risks from the European carbon border adjustment mechanism. Energy Research & Social Science 80, 102240. https://doi.org/10.1016/j.erss.2021.102240

Espa, I., 2022. Reconciling the Climate/Industrial Interplay of CBAMs: What Role for the WTO? AJIL Unbound 116, 208–212. https://doi.org/10.1017/aju.2022.31

Evans, M., Kramarchuk, R., Dorner, J., Williams, M., Giordano, S., Feng, X., Peng, Y., 2024. EU Carbon Border Adjustment Mechanism to raise $80B per year by 2040. S&P Global.

Greiner, S., Michaelowa, A., De Lorenzo, F., Kessler, J., Krämer, N., Hoch, S., Gläser, A., Rubertus, E., Tänzler, D., Machnik, D., 2020. Article 6 piloting: State of play and stakeholder experiences.

Haya, B., Cullenward, D., Strong, A.L., Grubert, E., Heilmayr, R., Sivas, D.A., Wara, M., 2020. Managing uncertainty in carbon offsets: insights from California’s standardized approach. Climate Policy 20, 1112–1126.

Hua, P.D., 2023. What Makes Border Tax Adjustment for CO 2 in the WTO So Controversial? The Example of the EU Proposal. The Example of the EU Proposal (April 25, 2023).

Klepper, G., Peterson, S., 2006. Emissions trading, CDM, JI, and more: the climate strategy of the EU. The Energy Journal 27, 1–26.

Koch, N., Fuss, S., Grosjean, G., Edenhofer, O., 2014. Causes of the EU ETS price drop: Recession, CDM, renewable policies or a bit of everything?—New evidence. Energy Policy 73, 676–685. https://doi.org/10.1016/j.enpol.2014.06.024

Nazifi, F., 2010. The price impacts of linking the European union emissions trading scheme to the clean development mechanism. Environmental Economics and Policy Studies 12, 164–186.

Pleeck, S., Mitchell, I., 2023. The EU’s Carbon Border Tax: How Can Developing Countries Respond? Center for Global Development.

Rafiqi, I.D., Mentari, N., 2024. Comparison of Carbon Trading in Asean Countries: An Explanation From a Policy Perspective. Journal of Law and Policy Transformation 9, 1–18.

Ruiz, M.A.G., 2023. The Achilles heel of border carbon adjustments: unintended effects on developing countries, in: Taxation and the Green Growth Challenge. Edward Elgar Publishing, pp. 69–83.

Sandler, E., Schrag, D., 2022. Financing the Energy Transition through Cross-Border Investment. Science, Technology, and Public Policy Program Paper Series.

Shrestha, A., Eshpeter, S., Li, N., Li, J., Nile, J.O., Wang, G., 2022. Inclusion of forestry offsets in emission trading schemes: insights from global experts. Journal of Forestry Research 33, 279–287.

The Economist, 2023. CBAM will force change in carbon-intensive sectors. The Economist.

Ursula von der Leyen, P. of the Eur.C., 2020. State of the Union Address.

World Bank, 2023. Scaling Up to Phase Down: Financing Energy Transitions in the Power Sector.

World Bank. 2024. State and Trends of Carbon Pricing 2024. © Washington, DC: World Bank. http://hdl.handle.net/10986/41544

Sandler, Ely and Daniel Schrag. “Leveraging Border Carbon Adjustments for Climate Finance: Matching Carbon Tax Assets with Carbon Tax Liabilities.” Science, Technology, and Public Policy Program, Belfer Center, December 2, 2024

- Regulation (EU) 2023/956, Article 1

- Regulation (EU) 2023/956, Article 2 and Annex 1

- Regulation (EU) 2023/956, Article 32 and Article 33

- Regulation (EU) 2023/956, Article 22

- Regulation (EU) 2023/956, Article 21

- Regulation (EU) 2023/956, Article 24

- Regulation (EU) 2023/956, Article 7

- Regulation (EU) 2023/956, Article 7 and Annex 4

- Regulation (EU) 2023/956, Article 2 and Annex 9

- Regulation (EU) 2023/956, Article 9

- The power to adopt delegated acts is referred to in Articles 2, 18 and 27. Articles 2, 5 to 9, 21, 25, 31, 33 and 35 contain provisions on implementing powers”) although so far Article 9 has not been a priority as the Commission has focused on acts that have direct relevance in the transitionary period before full implementation (including paying for CBAM certificates) begins in 2026.